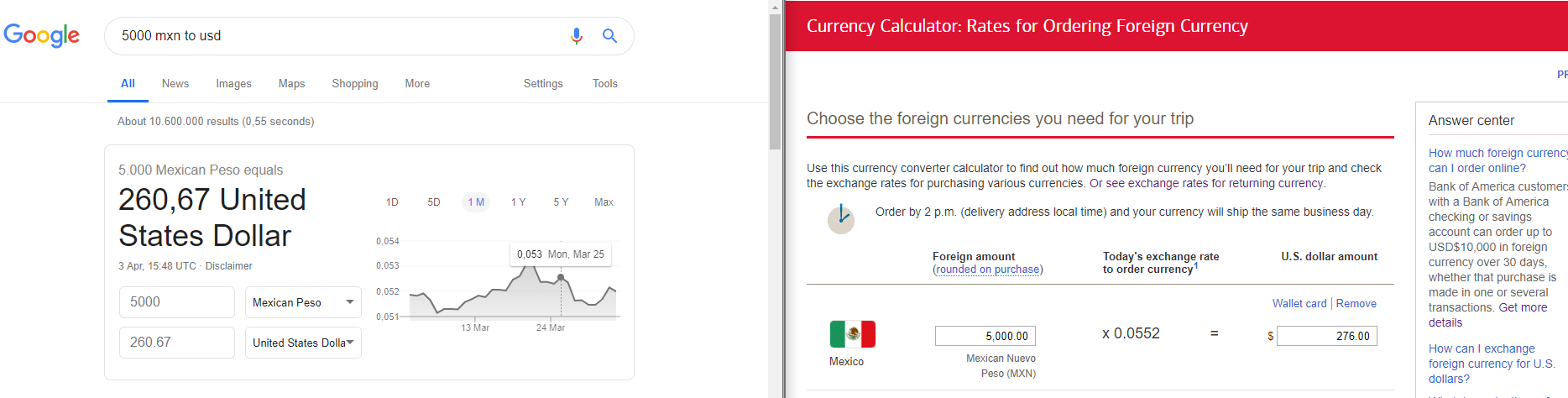

This is because once you’ve transferred money directly from your account, it’s much harder to claim it back if the recipient turns out to be untrustworthy.Īs a result, it’s best to avoid paying for goods or services with a bank transfer. A good rule of thumb is to never give out your account details to someone you don’t know, and to never make a bank transfer to somebody that you’ve only interacted with online. For instance, the GBP/USD pair has a markup of 4.6%.Ĭustomers can opt for money remittance companies that offer exchange rates close to the mid-market rates.How to transfer funds from one bank to another domesticallyīefore you transfer money to another account, ensure that you can trust the person that you’re sending your money to. Customers can expect a markup of 4%-6%, depending on the currency. The rates are different from the mid-market rate because they reflect an all-in-pricing. You’ll typically find a stronger exchange rate by using a specialist money transfer operator to send your money abroad, so it’s worth comparing your options to see if you can get a better deal.īank of America exchange rates are available online. You should be shown the Bank of America exchange rate before you lock in your foreign exchange transaction. Bank of America Foreign Currency Exchange Rates Bank of America states that they determine the foreign exchange rates offered to customers using a variety of factors including market conditions, how much foreign currency you need, exchange rates charged by other financial institutions, our desired rate of return, market risk, credit risk and other market, economic and business factors’. The mark-up you will be charged on the exchange rate differs depending on the currency pair you are converting between, and isn’t always made explicitly clear. For example, if you would like to send money to USA from UK, just select GBP and convert it to USD. Just select the currency you would like to convert. You can check the foreign currency exchange by checking our currency converter tool where you will see the real exchange rate. This means that you will not be able to convert your cash at the same exchange rate that you find on Reuters or Google, for example. Bank of America Exchange RatesĪs with most banks, Bank of America adds a margin onto the mid-market exchange rate at which banks buy and sell currency to one another when sending money internationally for its customers. Let’s examine how Bank of America handles transfer costs. Cumulatively, these charges form the bulk of international transfer costs. US banks typically charge high fees and apply margins on the exchange rates. If you’re looking to make an international transfer with Bank of America, it’s important to have a good understanding of the fees you’re likely to incur as well as the Bank of America exchange rate margin applied to your foreign exchange transaction.

Get rates Bank of America Exchange Rates and Fees

#BANK OF AMERICA INTERNATIONAL TRANSFER HOW TO#

This review covers everything you need to know about Bank of America, including how to open an account, pros and cons, a breakdown of the fees, charges and exchange rates you can expect when making a transfer with Bank of Americaand how to transfer your money. As well as banking and wealth management, Bank of America is also is a global leader in corporate and investment banking and trading. Bank of America is one of the world’s largest financial institutions, serving around 56 million US customers and small-and-middle-market businesses.

0 kommentar(er)

0 kommentar(er)